Dynamic pricing application opens up print advertising opportunities for Times of India

Print Innovations | 13 June 2022

The print segment in India is expected to reach US$3.2 billion by 2024 with a compounded annual growth rate of 4% driven by resumption of business activity across the country. More than 30,000 advertisers advertised in only The Times of India last year.

With newspapers still widely read, especially for local content, the print medium in India is thriving as a relevant impactful and influential medium. Higher costs and costlier newsprint have led to significant cost inflation, which has emphasised the importance of revenue recovery to pre-pandemic levels.

With current daily ad volumes already higher than pre-COVID-19 levels, revenue growth will depend on the ability to increase advertising rates. It is in such situations that intelligent pricing models are required. And The Times of India has always been at the forefront of such innovations.

The Times of India was the first media entity in India to have a centralised pricing structure — conceptualised, developed, and architected with the dynamic pricing application IntelliQuote (IQ) — which recommends client-specific prices in real time. The algorithm is designed in such a manner that it triangulates prices from two different logics and the machine learns progressively by presenting a scientific price for a given category or client.

Prior to IQ, all new client discussions used to happen manually. This was via a telephone or mail conversation between the sales and pricing team. Some of the drawbacks of this process included:

- A requirement of manual intervention for negotiation between sales and pricing.

- It was prone to human error as huge volumes are evaluated simultaneously.

- No data was captured on lost businesses or unclosed cases.

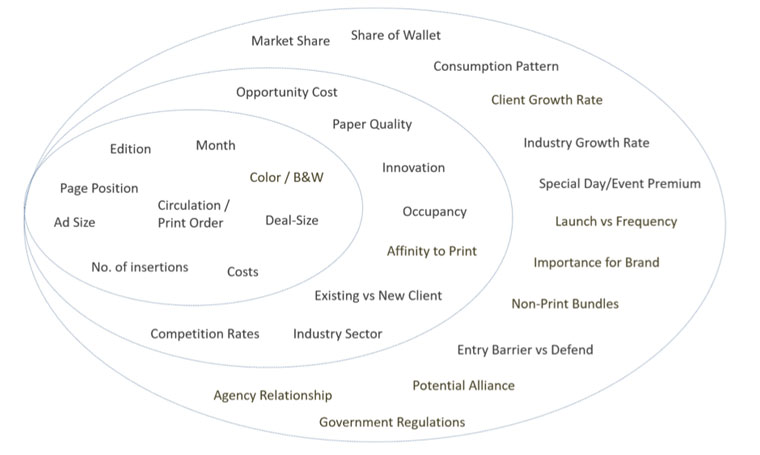

IQ created a process that requires less human interaction and a more objective approach to pricing. This IQ rate is derived analytically through regression, keeping several factors in mind with data used from multiple years. This rate is the standard, from which possible deviation is evaluated by the pricing team and finally offered to the client. With new data being captured daily, the system/machine becomes increasingly intelligent. This improves the accuracy and reduction in time for closure of deals.

Some of the factors considered by the IQ system are:

- Publication.

- Inventory (page and size).

- Day of the week.

- Client/category and context.

While the existing models focus on optimal pricing by edition, it is possible to develop an algorithm that can deliver more — from discovering untapped spend potential for relevant clients across various media to simultaneously proposing optimal pricing for each identified solution.

It will be a paradigm shift from manual buying toward programmatic. Programmatic buying will help sell inventory with a low probability of fill. Analytics will be the key to unlocking optimal pricing to drive such revenue efficiencies.

Examples of this include:

• Inventory analytics: Identify inventory with a low future probability of fill. Accurate visibility of inventory fill will help leverage optimal pricing. This is essential from a revenue maximisation perspective.

• Pricing transactions: Analysis of pricing transaction history along with a keen domain knowledge to treat outliers or exceptions forms the basis for accurate predictions of client consumption behaviour and spending patterns. This helps leverage pricing opportunities based on various variables verticals, seasonality, and editions.

• Opportunities: Opportunity identification with untapped potential clients spending across various media. Opportunity identification can be further fine-tuned to improve benefit-to-effort ratio. Fine-tuning is based on criteria like relevance to print, category of ad, client actively spending, current mix and change in mix, and spending levels. Essentially, its two-pronged goal is to ensure optimal pricing with minimal manual interventions, and drive incremental revenue and maximise available inventory.